Montana State Legislature

Department of Commerce

The Department of Commerce partners with communities, businesses, and organizations across the state to strengthen Montana’s economy. The Department supports the development of affordable communities, promotes Montana’s nature and towns, and supports the innovative and sustainable industries which strengthen Montana’s economy.

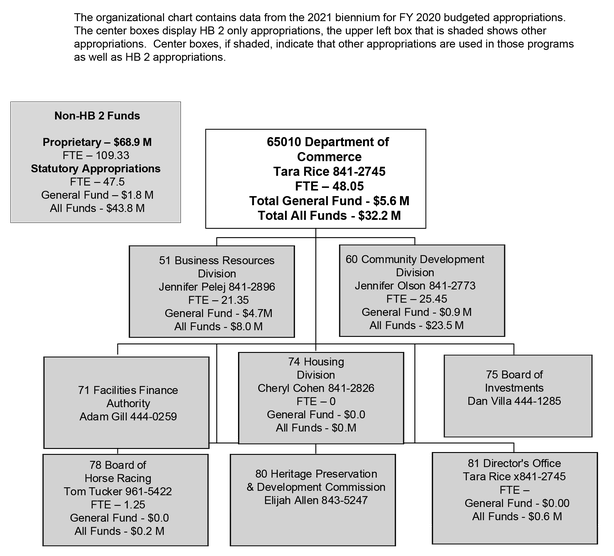

The Department of Commerce provides these services through a structure consisting of eight divisions with the following functions:

Montana Office of Tourism and Business Development

- Organization

- Budget and Operations Bureau

- Marketing Bureau

- Industry Services and Outreach Bureau

- Business Assistance Bureau

- Research and Information Services Bureau

- Services Provided

- Provides businesses with technical assistance through the Small Business Development Center and trade and international relations

- Provides Census and Economic Information Center data

- Provides economic development assistance to tribal governments through the Office of Indian Country Economic Development and the State Tribal Economic Development Commission

- Markets and promotes Montana tourism and film industries

Community Development Division

- Organization

- Community Development Block Grant Program (CDBG)

- Community Technical Assistance Program (CTAP)

- HOME Investment Partnership Program (HOME)

- Treasure State Endowment Program (TSEP)

- Housing Trust Fund (HTF)

- Coal Board

- Hard Rock Mining Impact Board

- Services Provided

- Awards CDBG, which are federal funds, to local governments for community development, housing, and public facility projects

- Awards state funded grants in the TSEP to local governments, water and sewer districts, and tribes’ for infrastructure projects throughout the state; grants are awarded by the Legislature

- Awards state funded grants to local governments, tribes, school districts, and special districts to remediate effects of coal mining on communities in designated coal development areas

- Provides technical assistance, analysis, mitigation, and mediation services to local governments and hard rock mining developers where potentially adverse public fiscal impacts from large scale development are identified

- Provides state funded grants and technical assistance to non-profit organizations and local governments for downtown revitalization and historic preservation

- Awards federal funded block grants in the HOME to create affordable housing for low income households Awards federal funded block grants in the HTF to create affordable housing for extremely low-income households

- Provides technical assistance in land use and planning to local governments and the public and private sector for the purposes of aiding and encouraging orderly, productive, and coordinated development of the communities of the state (CTAP)

Facility Finance Authority

- Assists non-profit healthcare and human service facilities and pre-release centers acquire low-interest and low-cost capital financing

Housing Division

- Supports safe and affordable housing in communities throughout Montana through rental assistance, federal housing tax credits, construction financing, rehabilitation financing, and low interest mortgages

Board of Investments

- Invests essentially all State of Montana funds including daily cash amounts, trust funds, and pension monies

- Provides short-term investment alternatives to local governments

- Administers loan programs that support Montana businesses and municipalities

Board of Horse Racing

- Monitors and regulates the horse racing industry in Montana

Heritage Preservation and Development Commission

- Manages and preserves historic cultural properties and artifacts for the State of Montana (notably Virginia City, Nevada City, and Reeder’s Alley in Helena)

Director’s Office

- Provides overall leadership, communication, and management support to agency staff, programs, bureaus, divisions, and administratively attached boards

- Maintains a federally funded contract with the Montana Council on Developmental Disabilities

Below is an organizational chart of the office, including full-time employee (FTE) numbers and the HB 2 general fund expenditures and total expenditures from all funds.

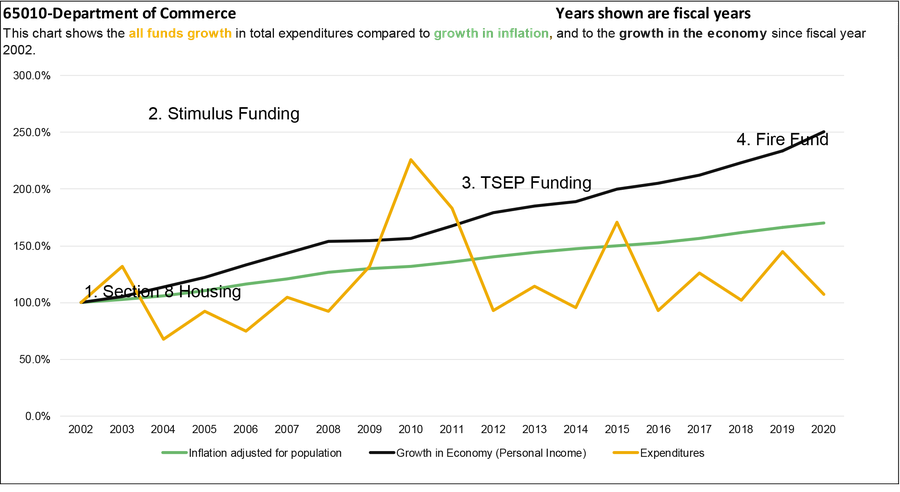

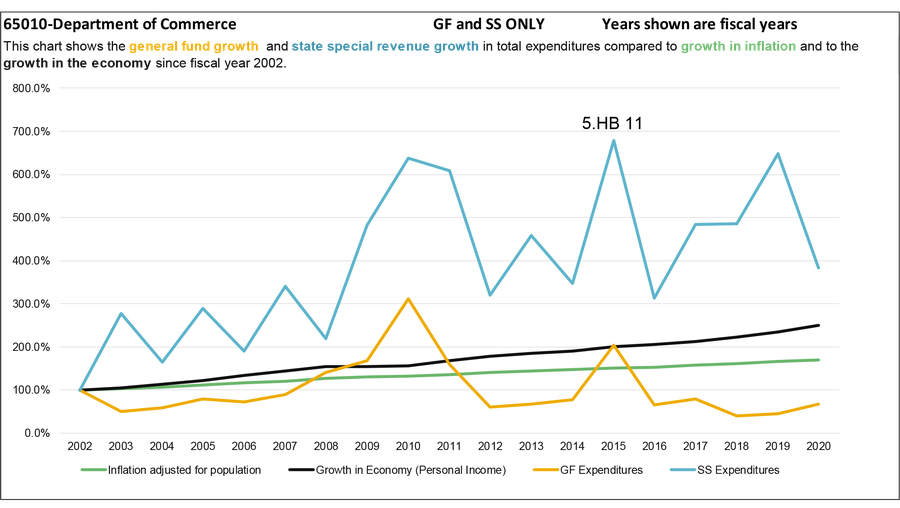

This report includes a series of charts that compare expenditure growth to the growth in the economy and growth in inflation adjusted for population. Montana statute, 17-8-106, MCA, recommends using growth in personal income for comparison purposes. Personal income is a measure for growth in the economy. Comparing growth allows financial planners to consider past and future demands in services or changes in revenues.

The following list discusses in more detail the inflection points on the charts:

- In the 2005 biennium, the legislature shifted $82 million in federal special revenue and 19.50 FTE for Section 8 housing in the Housing Division to the enterprise fund. As the enterprise fund is not considered part of governmental funds, this change permanently reduced the appropriation level included in HB 2;

- As part of the state’s response to the Great Recession, the legislature approved $29 million in general fund and $34.95 million in state special revenue in the 2011 biennium for infrastructure projects in local governments including:

- American Recovery and Reinvestment Act (ARRA) funding of $4 million in historic preservation

- ARRA funding of $45 million, $20 million to school districts, $20 million to local governments, and $5 million to tribal governments

- $14.95 million for quick start energy grants available to local school districts;

- In the 2015 biennium the legislature approved $35 million in state special revenue expenditures for the Treasure State Endowment Program in HB 11 and $12.4 million in expenditures for quality school facility grants;

- SB 4, enacted by the 2017 November Special Session, established a management rate transfer of 3% on the Board of Investments portfolio if the average asset balance was greater than $1 billion and the balance

- contained sufficient funds to offset all liabilities. The management rate transfer was to be made to the fire suppression account;

General fund

Increased general fund support for expenditures in FY 2009 of $7.6 million, $24.5 million in FY 2010, and $10.4 million in FY 2011 were due to the investment in local government infrastructure. In FY 2015, HB 11 authorized a transfer of $13.3 million in general fund to the treasure state endowment account in the state special revenue fund to provide sufficient funding for the total projects approved in the bill.

State special revenue

Most of the growth in expenditures within the Department of Commerce has been supported by state special revenue. In FY 2009, FY 2010, FY 2011, and FY 2015 increases in state special revenues are due to increased support for infrastructure as previously discussed. In FY 2018, $14.7 million and $13.6 million in FY 2019 in state special revenue was paid into the state fire suppression fund.

Click the double-sided arrow in the lower right corner of the image below to enlarge the graphic. Then, click the box next to the agency you want to see. To minimize, click Esc.

Legislative Studies

Economic Affairs Interim Committee work

Audit Reports

Financial Compliance Audit - Montana Facility Finance Authority - March 2019

Performance Audit - Tourism Marketing & Promotion - Oct 2019

Financial Compliance Audit - Department of Commerce - March 2020

See information under the "Legislation" tab on the Economic Affairs Interim Committee page

Legislation:

SB 329, Revise board of investment laws

SB 330, Revise financial investment policy laws

HB 589, Revise disposition of civil fines under consumer protection act

HB 437, Repeal the board of research and commercialization technology

Agency profile information provided by the Legislative Fiscal Division.