Montana State Legislature

Department of Revenue

The Department of Revenue (DOR) administers state taxes except for gasoline and motor fuel taxes administered by the Department of Transportation, insurance taxes administered by the State Auditor, and video gaming tax administered by the Department of Justice. DOR administers and enforces Montana’s tax laws, appraises all property subject to state and local property taxes, administers the Montana Alcoholic Beverage Code, enforces the Montana Cigarette Sales Act, and administers abandoned property. The primary statutory references defining duties and responsibilities of DOR are found in 2-15-1301, MCA, 15-1- 201, MCA, and Title 15, MCA.

DOR collects and distributes revenue from and enforces regulations for 40 state taxes and fees through five divisions. It also regulates the sale and distribution of alcoholic beverages in Montana by buying, importing, storing, selling, and delivering liquors to agency liquor stores.

In addition, DOR:

- Administers and enforces Montana’s tax laws

- Appraises all property subject to state and local property taxation

- Administers the Montana Alcoholic Beverage Code

- Enforces the Montana Cigarette Sales Act

- Administers abandoned property

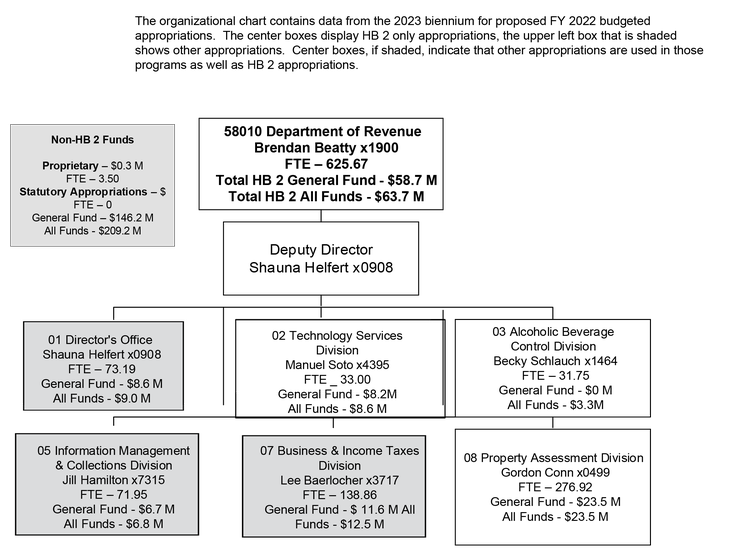

Below is an organizational chart of the office, including full-time employee (FTE) numbers and the HB 2 general fund expenditures and the total expenditures from all funds. Unless otherwise noted, all phone extensions are preceded by (406) 444.

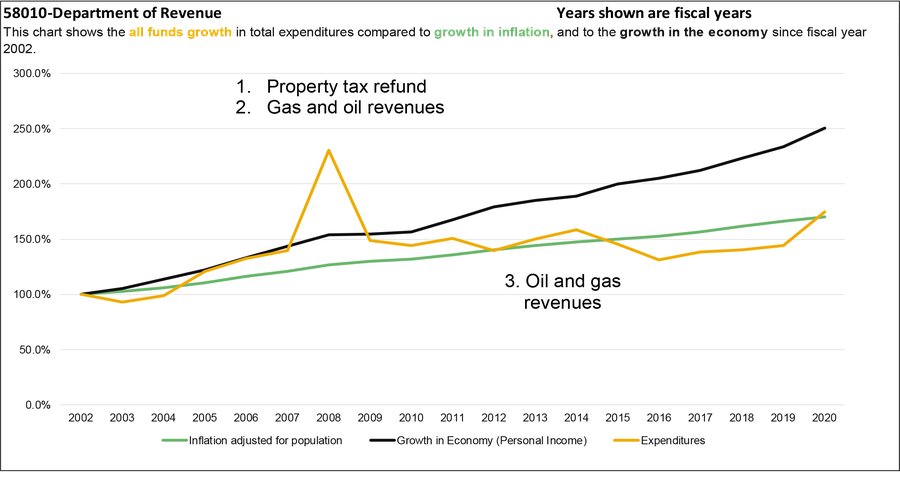

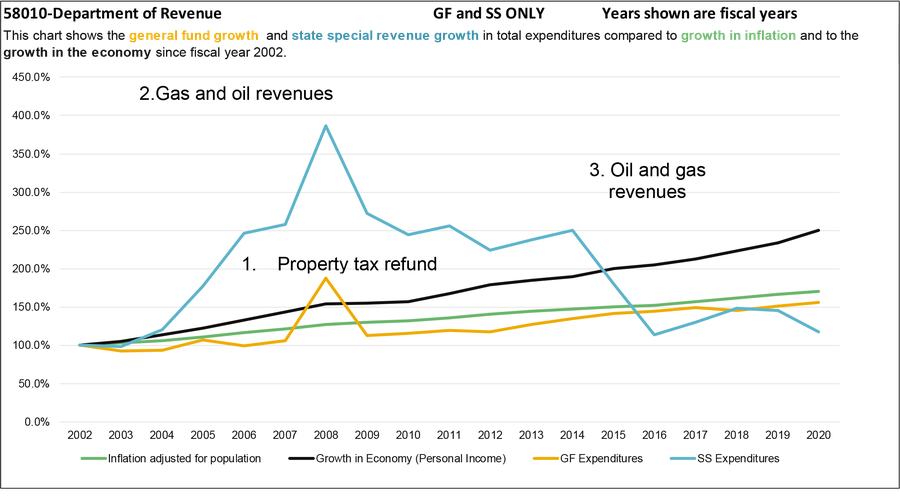

This report includes a series of charts that compare expenditure growth to the growth in the economy and growth in inflation adjusted for population. Montana statute, 17-8-106, MCA, recommends using growth in personal income for comparison purposes. Personal income is a measure for growth in the economy. Comparing growth allows financial planners to consider past and future demands in services or changes in revenues.

In general, all funds growth in total expenditures for the Department of Revenue has been lower than the rate of inflation adjusted for population.

The following list discusses in more detail the inflection points on the charts:

- HB 9 from the May 2007 Special Session provided $0 million in general fund for a property tax refund of up to $400 of the 2006 Montana property taxes paid on principal residences;

- Department of Revenue (DOR) provides revenue distributions to local governments including local assistance for oil and natural gas distributions. The largest component of oil and natural gas distributions is the oil production tax. In FY 2008 distributions for oil production tax increased $51.8 million from $97.9 million in FY 2007 to $149.7 million in FY 2008 due to increased activity in the Bakken oil fields. Subsequently these distributions have declined as oil production in Montana has declined;

- Oil and natural gas production declined between FY 2014 and FY 2016. Oil production taxes distributed to local governments dropped from $96.7 million in FY 2014 to $63 million in FY 2015 and $39.2 million in FY 2016.

- Liquor purchases and freight, licenses and excise taxes, and liquor licensing increase in total by $12 million in FY 2020

General Fund

The annual growth rate for general fund expenditures between FY 2002 and FY 2019 was 2.3%. About 70% of the general fund appropriation in the Department of Revenue is for entitlement share payments to local governments. HB 124, passed during the 2001 Legislative Session, revised laws governing local and state government revenue collection and allocation. The state would assume control of alcohol, vehicle, and gambling taxes as well as district court fees; in return, the state would reimburse local governments for the lost revenue in the form of an entitlement share payment and assume the costs associated with district courts and local welfare offices. In FY 2007, the passage of SB 146 created the Office of the Public Defender (OPD) and the state assumed control of district courts and local welfare office costs. As a result, local governments’ entitlement share payments were slightly decreased to account for the increased costs to the state.

State Special Revenue

State special revenues supports statutory appropriations for local assistance distributed to local and tribal governments including:

- Beer, wine, tobacco, and cigarette taxes

- Oil and natural gas production taxes

- Metal mine taxes

- Bentonite production taxes

Over 80% of the distribution is for oil production taxes in any given year.

It should be noted that between FY 2002 and FY 2009 this also included coal gross proceeds taxes. Changes in statute eliminated this distribution in subsequent years.

Click the double-sided arrow in the lower right corner of the image below to enlarge the graphic. Then, click the box next to the agency you want to see. To minimize, click Esc.

Legislative Studies

Revenue Interim Committee work

Audit Reports

Performance Audit: Tax Increment Financing Administration and Impact - Feb 2018

Financial Compliance Audit - For the two fiscal years ended June 30, 2018

Performance Audit - Short-Term Lodging and Rental Vehicle Taxes - April 2020

Legislation:

HB 191, Revise residential property tax credit for elderly

HB 190, Revise tax rate for golf courses

HB 191, Revise residential property tax credit for elderly

HB 193, Allow unlimited winnings for sports boards

HB 201, Revise prevailing wage district laws and dispatch city designations

HB 203, Revise reporting requirements for third-party settlement

HB 204, Provide tax credit for volunteer first responders

HB 205, Provide tax credit for employers of volunteer first responders

HB 214, Revise distribution of horseracing gambling fees

HB 240, Revise state income tax deduction for certain dependents

SB 133, Revise property tax appeal and tax appeal process

SB 138, Repeal temporary tribal property tax exemption

HB 252, Non-refundable tax credit for employer paid education of trade professions

HB 253, Revise laws related to charitable trusts

HB 259, Revise property and zoning laws

SB 154, Revise collection of delinquent coal gross proceeds taxes

HJ 5, Resolution about federal taxation of guns

HB 261, Constitutional amendment for taxpayer protection act to limit tax types

HB 262, Expand exemptions from collections to include student loans

HB 263, Revise exemption from collection laws

HB 284, Provide living wage

HB 279, Revise laws related to tax credit scholarship and innovative education programs

HB 288, Provide business property tax exemption during state of emergency or disaster

HB 303, Revise business equipment tax laws: BIG Jobs Act

HB 304, Revise definition of community land trusts

HB 298, Revise information included on property valuation statement

SB 190, Establish valid tip pool agreements

SB 159, Personal Income Tax Relief

SB 162, Exempting religious organizations from certain campaign finance laws

SB 181, Corporate Tax Modernization Act

SB 182, Revise laws on state finance, reducing tax rate if conditions met

SB 184, Magnet Act

SB 176, Revise laws related to coal, coal tax, and coal-fired unit remediation

SB 193, Revise appraisal requirement for tax-deed land that did not sell at auction

SB 205, Revise name of state tax appeal board

SB 212, Revise laws related to property tax bills

SB 214, Revise laws related to temporary tribal property tax exemption

HB 372, Eliminate business equipment tax

HB 394, Exempt certain pollution control and carbon capture equipment from property tax

HB 397, Establish workforce housing tax credits

HB 340, Revise the MEDIA Act film tax credits

HB 346, Revise renewable energy laws

HB 357, Revise property tax assistance program inflation adjustment laws

HB 348, Revise film tax credit

HB 363, Provide for tax on digital advertising services

HB 516, Revise property entry laws for property tax valuation purposes

HB 521, Revising property exempt from execution

HB 409, Provide tax credit for purchase of a firearm safe

HB 424, Revise individual income tax laws

HB 431, Revise property tax on intangible personal property

HB 432, Revise property tax exemptions for affordable housing

HB 473, Revise resort tax laws

HB 464, Repeal local option gas tax

SB 262, Revise forest lands taxation advisory committee

SB 263, Revise forest lands property taxes and rates

SB 269, Allow mobile homeowners the option to purchase a mobile home park

HB 525, Revise laws related to alcohol concession agreements

HB 526, Revise county assessor laws

SB 313, Provide for local option tax: Montana Tax Fairness and Rural Revenue Initiative

SB 320, Revise business law pertaining to alcohol delivery

SB 253, Revise state income tax medical care savings account investment options

SB 288, Revise property exemption for agricultural processing facilities

HB 534, Revise microbrewery laws

HB 619, Revise property tax exemptions for certain hospitals

Jan. 7 Budget

Nov. 15 Budget

Agency profile information provided by the Legislative Fiscal Division.