Montana State Legislature

Department of Transportation

The Montana Department of Transportation (MDT) mission is to serve the public by providing a transportation system and services that emphasize quality, safety, cost effectiveness, economic vitality, and sensitivity to the environment. The primary statutory references include - Article VIII, Section 6, Montana Constitution, 2-15-2505, 15-70, Titles 60, 61, and 67, MCA.

The director acts as liaison between the Transportation Commission (commission) and the department. The commission is comprised of five members appointed by the Governor and confirmed by the Senate for four-year terms. The commission determines construction priorities, selects construction projects, awards construction contracts, and allocates funding to state, local, and national highway system projects. The commission also designates highways to be placed on the national highway system and state primary, secondary, and urban highway systems along with those in the state maintenance system.

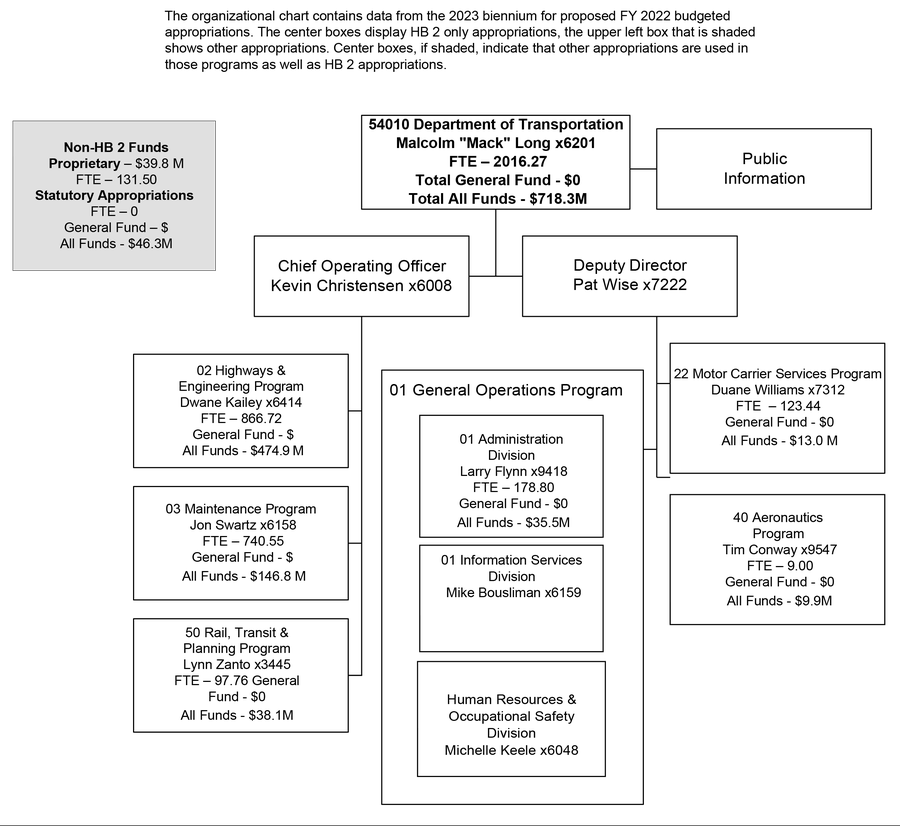

Below is an organizational chart of MDT, including full-time employee (FTE) numbers and the HB 2 general fund expenditures and total expenditures from all funds. Unless otherwise noted, all phone extensions are preceded by (406) 444.

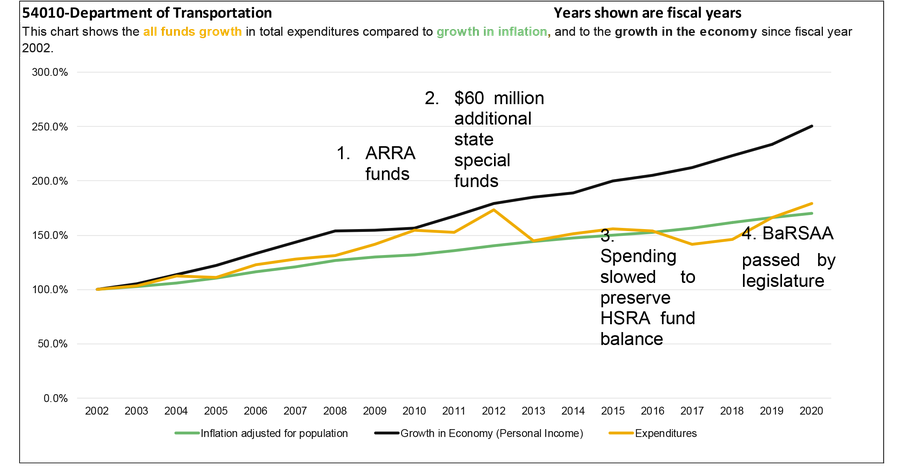

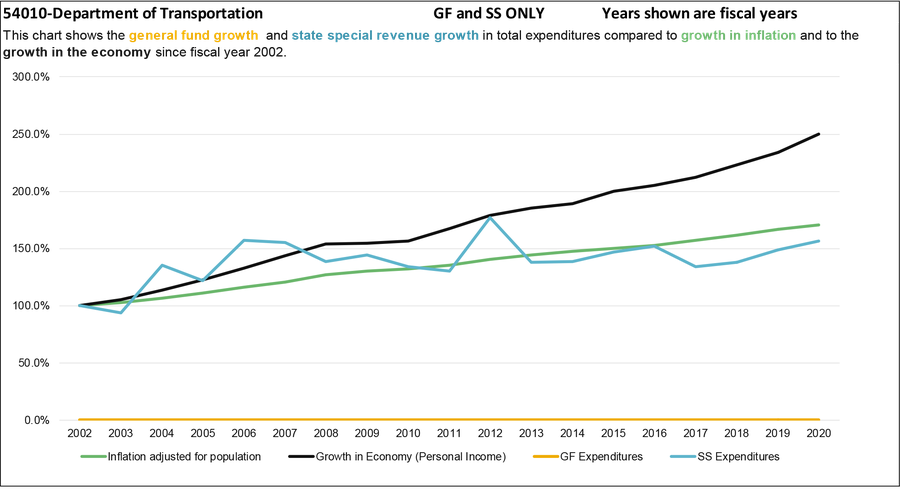

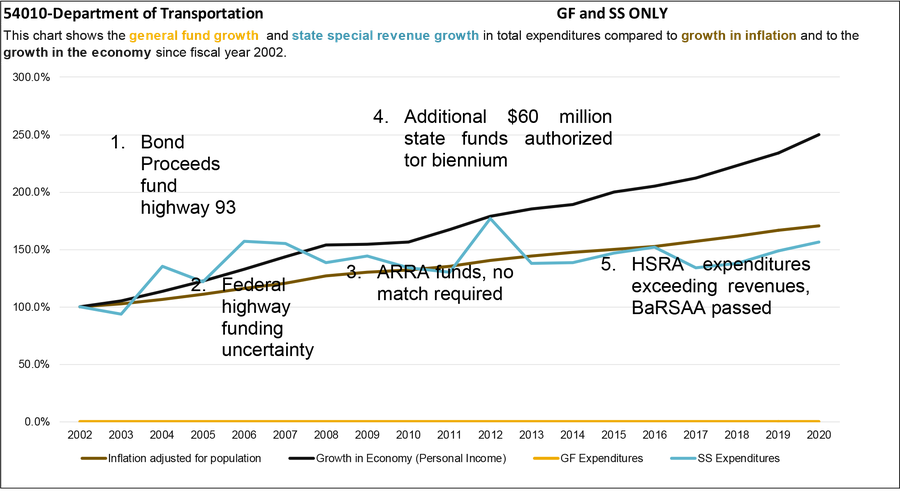

This report includes a series of charts that compare expenditure growth to the growth in the economy and growth in inflation adjusted for population. Montana statute, 17-8-106, MCA, recommends using growth in personal income for comparison purposes. Personal income is a measure for growth in the economy. Comparing growth allows financial planners to consider past and future demands in services or changes in revenues.

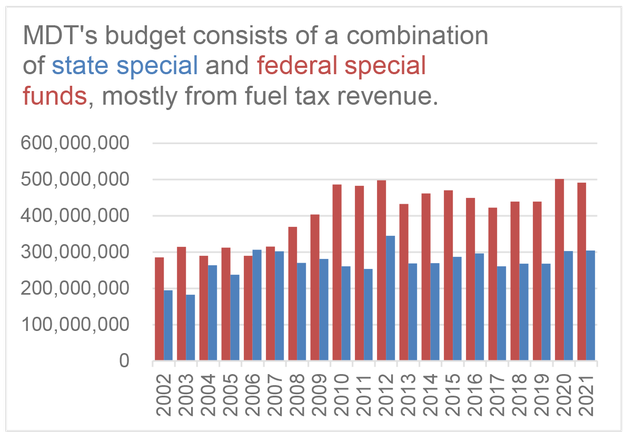

The Montana Department of Transportation’s (MDT) budget generally consists of 60% federal special funds and 40% state special revenue funds which mostly come from fuel taxes. In general, growth of all funds expenditures for the Montana Department of Transportation (MDT) parallels the growth in population and inflation with occasional adjustments related to availability of state and federal funds as described below.

State funds are used to match federal funds as well as support the 100% state funded construction program as well as highway maintenance.

The following list discusses in more detail the inflection points related to governmental expenditures:

- During FY 2009-2011 the department had an influx of $200 million in federal funds from the American Recovery and Reinvestment Act (ARRA.) The program funded shovel-ready projects 100% with federal dollars and required no state match. These funds were available for a limited time and therefore prioritized to be spent, resulting in less spending from MDT’s Highway State Special Revenue Account (HSRA) and a corresponding increase in the HSRA fund balance.

- In FY 2011 the legislature authorized an additional $60 million for state funded construction projects to be completed during the 2013 biennium, decreasing the balance of the HSRA.

- From FY 2011-2017 HSRA expenditures exceeded revenues, chipping away at the fund balance amassed from the ARRA savings. HSRA fund balance at the end of FY 2011 was nearly $100 million, but had been reduced to $36 million by the end of 2016. Federal funds are paid to the state on a reimbursement basis, requiring MDT to maintain sufficient HSRA fund balance for cash flow purposes. During this time spending was slowed to preserve the HSRA fund balance.

- In FY 2017 the Bridge and Road Safety and Accountability Act (BaRSAA) was passed, gradually increasing state fuel tax through 2023.

General Fund

The MDT has dedicated streams of income and does not use general fund.

State Special Revenue

State special revenue for the MDT is derived primarily from fuel taxes. Fuel is taxed at a set per gallon rate that is not adjusted for inflation, accordingly the rate of growth of state special revenue expenditures has been lower than the growth of population and inflation.

The following list discusses in more detail the inflection points related to state special revenue changes in total expenditures:

- The budget for FY 2004-2005 included federal GARVEE bond proceeds for Highway 93 which added $87.6 million to state special revenue for the biennium.

- From 2004-2007 state special revenue expenditures came close to or exceeded federal special revenue expenditures. At this time the federal highway bill TEA-21 had expired in the first quarter of SFY 2004 and posed great uncertainty in the availability of federal funding. The next federal transportation act was not signed until fall of 2005.

- From FY 2009-2011 the American Recovery and Reinvestment Act (ARRA), a federal program instituted during the great recession, provided over $200 million in federal funds that did not require a state match. As a result, state special revenue spending decreased.

- The 2011 legislature authorized $60 million additional state funds for construction projects in the 2013 biennium.

- In 2017 the legislature passes HB 473, the Bridge and Road Safety and Accountability Act (BaRSAA) which gradually increases state gas and diesel taxes.

Click the double-sided arrow in the lower right corner of the image below to enlarge the graphic. Then, click the box next to the agency you want to see. To minimize, click Esc.

Legislative Studies

Transportation Interim Committee work

Audit Reports

Performance Audit - Funding Montana's Highway Infrastructure - June 2018

Performance Audit - An Examination of MDT's Maintenance Division - June 2018

Financial Compliance Audit - MDT - Dec 2019

Legislation

See information under the Legislation tab on the Transportation Interim Committee web page

HB 306, Revise transportation laws relating to tourism

HB 308, Revise dyed diesel tax laws

HB 309, Add tribal police/agents to MDT forms

HB 281, Revise laws related to E bikes

HB 326, Revise bicycle laws

HB 301, Require additional illumination at rail crossings

HB 354, Revise laws regarding driving while intoxicated costs

HB 365, Revise motor carrier rate regulation laws

HB 375, Designate the Douglas Martin Miller memorial highway

HB 383, Revise laws regarding three-wheeled motorcycles

HJ 10, Study regarding autonomous vehicle use in Montana

HB 562, Revise highway encroachment laws

HB 595, Revise laws related to salvage vehicles

HB 610, Establish the Terry Spotted Wolf, Sr. memorial highway

SB 359, Allow gates on certain county roads

SB 883, Establish Judge Pedro Hernandez memorial highway

HB 476, Revise commercial tow truck classification standards

HB 494, Revise transportation construction law

SB 285, Provide gas and fuel tax refund for agriculture

HB 420, Revise bicycle laws

Gov. Gianforte 2023 Biennium Budget - Department of Transportation

2023 Biennium Executive Summary - Department of Transportation

Jan. 7 Budget

Nov. 15 Budget

Agency profile information provided by the Legislative Fiscal Division.