Montana State Legislature

Governor's Office

The mission of the Governor’s Office is to oversee and direct the activities of the Executive Branch of the Montana state government, consistent with statutory and constitutional mandates. The Office of the Governor exists under authority granted in Article VI of the Montana Constitution. The primary statutory references defining duties and responsibilities of the office are found in Title 2, Chapter 15, Part 2; Title 53, Chapter 20, Part 1 (53-20-104, MCA); and Title 90, Chapter 11, Part 1 of the Montana Code Annotated.

The Governor’s Office provides services through a structure consisting of seven divisions. Services provided within the office include:

- Maintaining the executive residence and aircraft,

- Analyzing economic development proposals and issues,

- Planning, preparing, and administering the state budget and drafting fiscal notes,

- Interrelating with the state’s tribes,

- Providing information to citizens which allows them to gain accessibility to state government,

- Reviewing patient care in community mental health centers and facilities, and

- Protecting the rights of the mentally ill and developmentally disabled.

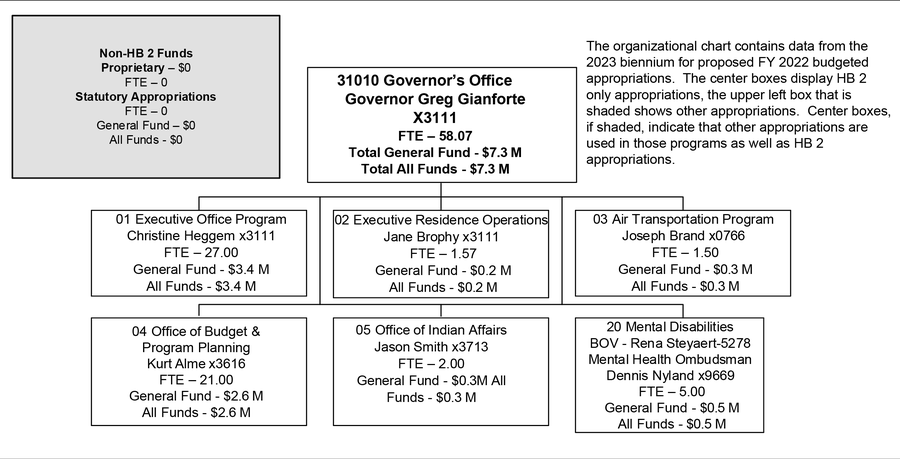

Below is an organizational chart of the office, including full-time employee (FTE) numbers and the HB 2 general fund expenditures and the total expenditures from all funds. Unless otherwise noted, all phone extensions are preceded by (406) 444.

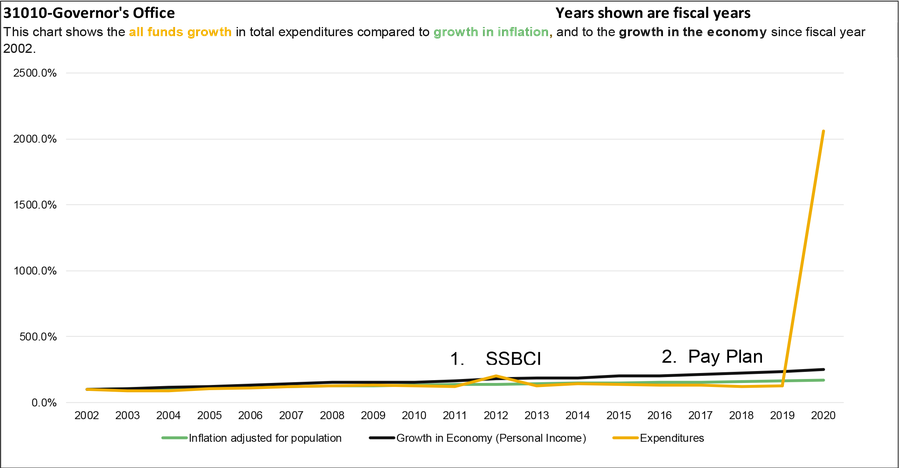

Due to the unusual amount of federal Coronavirus Relief Funds (CRF) that the Governor’s Office received from the federal government, which totaled $1.25 billion in appropriation authority in FY 2020, the expenditure growth in FY 2020 was 2,062.0%. Federal expenditures of $93.0 million for CRF in FY 2020 is reflected in the chart.

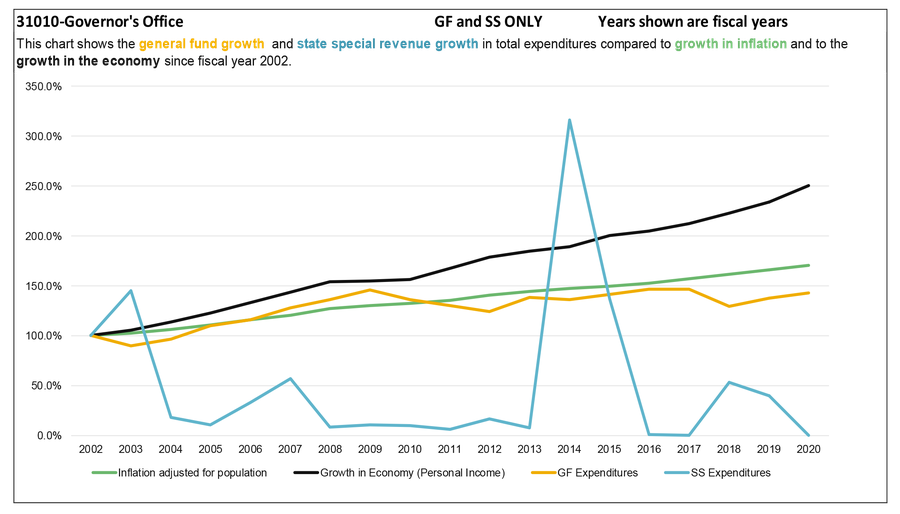

This report includes a series of charts that compare expenditure growth to the growth in the economy and growth in inflation adjusted for population. Montana statute, 17-8-106, MCA, recommends using growth in personal income for comparison purposes. Personal income is a measure for growth in the economy. Comparing growth allows financial planners to consider past and future demands in services or changes in revenues.

In general, all funds growth is total expenditures for the Governor’s Office has been lower than the rate of inflation adjusted for population. The following list discusses in more detail the inflection points on the charts.

- In response to the COVID-19 pandemic in FY 2020, the Governor’s Office received $25 billion in federal coronavirus relief funds. The appropriation was made to the Governor’s Office and then transferred to other state agencies charged with developing and administering various grant programs.

- Historically, the legislature provides a pay plan contingency in the pay plan bill. The appropriation is made to the Governor’s Office and then transferred to other state agencies that require additional funding for unanticipated personal service costs such as retirement payouts, those that cannot meet targeted vacancy savings amounts, or for legislation adopted with significant personal services costs not funded within the bill itself.

- Increases in expenditures in FY 2014 and FY 2015 are due to SB 410 (2013 session). This bill transferred $7.5 million into the Governor’s operations state special revenue account for the purpose of funding operations costs in several agencies (specified in the bill)

- The significant increase in expenditures in FY 2012 is due to the Governor’s Office receiving federal funds under the State Small Business Credit Initiative Act of 2010 (SSBCI). The purpose of the allocation was to assist the State of Montana in increasing the amount of capital made available by private lenders to small business through the Montana SSBCI Loan Participation Program

- State special revenue expenditures in FY 2002 and FY 2003 are primarily related to the Consensus Council, which did not have state special revenue expenditures after FY 2003 and was disbanded around FY 2009

General Fund

For the most part, the Governor’s Office is supported by general fund. The increases and decreases shown in the figure above include:

- FY 2009 there was the purchase of engines for the Governor's plane - nearly $650,000 general fund

- FY 2012 is impacted by general fund reductions, based on the submitted 5% reduction plan, approved by the legislature

- The reduction in FY 2018 expenditures is related to the reductions based on the 5% reduction plan approved by the legislature and reductions related to SB 261

State Special Revenue

With the exception of the appropriations discussed on the previous page, the Governor’s Office does not have state special revenue appropriations.

Click the double-sided arrow in the lower right corner of the image below to enlarge the graphic. Then, click the box next to the agency you want to see. To minimize, click Esc.

Audit Reports

Information Systems Audit - Unmanned Aircraft Systems Deployment and Oversight - June 2019

Financial Compliance Audit for the two fiscal years ended June 30, 2018

Performance Audit - State Employee Settlements - June 2020

Legislation:

Jan. 7 Budget

Nov. 15 Budget

Agency profile information provided by the Legislative Fiscal Division.