Montana State Legislature

Office of Public Instruction

The Superintendent of Public Instruction is an elected official authorized by Article VI, Section 1, of the Montana Constitution. The Office of Public Instruction (OPI) distributes funding to school districts and provides services to Montana's school-age children and to teachers in approximately 400 active school districts.

The core processes of the agency include:

- Licensure of educators,

- accreditation of schools,

- administration of statewide student assessments,

- distribution of state and federal grants/aid to schools,

- collection and reporting of data, and

- dissemination of information about K-12 education.

The superintendent’s staff provides technical assistance in planning, implementing, and evaluating educational programs in such areas as:

- Teacher preparation,

- teacher certification,

- school accreditation,

- academic standards and curriculum,

- school finance, and

- school law.

The staff also administers a number of federally funded programs and provides a variety of information services, including the information systems necessary to assess student achievement and the quality of Montana's elementary and secondary school system.

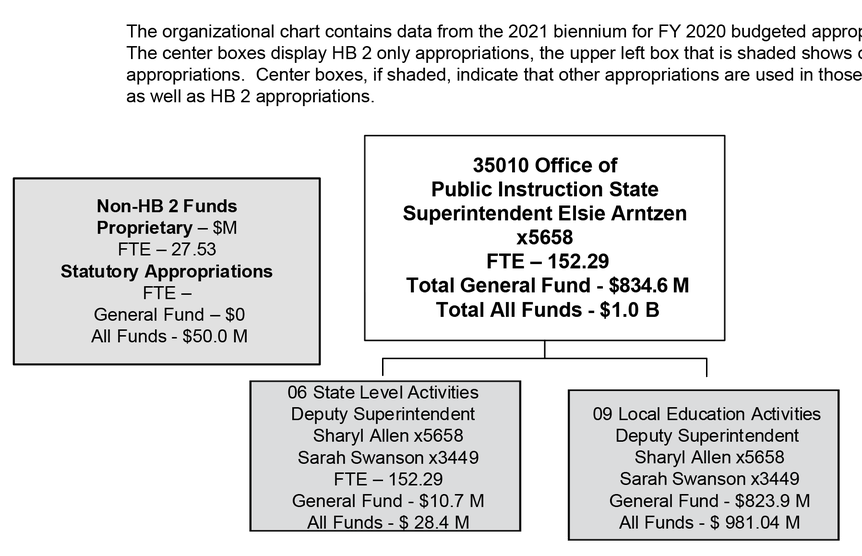

Services are provided through two programs. The State Level Activities program provides leadership and coordination of services to a variety of school and public groups.

Additionally, the program:

- Supports the Superintendent's statutory role with the Board of Public Education, Board of Regents, and Land Board

- is responsible for the distribution and accounting of state and federal funds provided to school districts

- maintains the information systems necessary to assess student achievement and the quality of Montana's elementary and secondary school system

- provides assistance and information to school districts

- administers all federal grants received by OPI, including curriculum assistance, special education, ESEA administration, secondary vocational education administration, and other educational services

The Local Education Activities Program is used by OPI to distribute state and federal funds to local education agencies.

Below is an organizational chart of the branch, including full-time employee (FTE) numbers and the HB 2 base general fund appropriations and the total of all funds. Unless otherwise noted, all phone extensions are preceded by (406) 444.

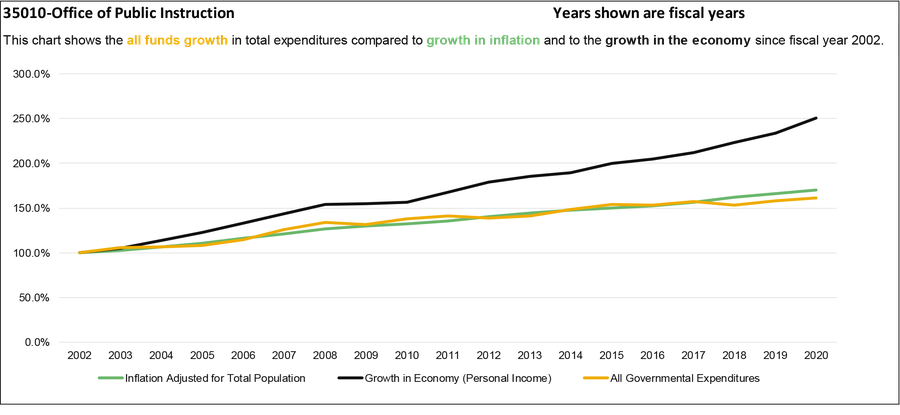

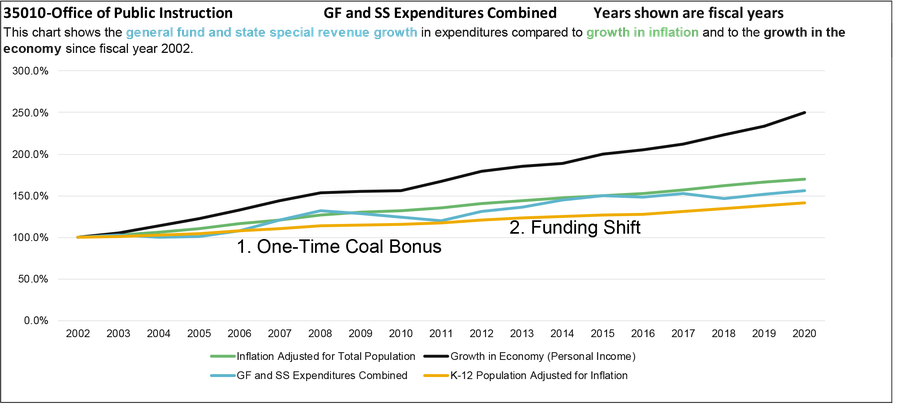

This report includes a series of charts that compare expenditure growth to the growth in the economy and growth in inflation adjusted for population. Montana statute, 17-8-106, MCA, recommends using growth in personal income for comparison purposes. Personal income is a measure for growth in the economy. Comparing growth allows financial planners to consider past and future demands in services or changes in revenues.

Though the growth of OPI funding closely follows the growth of population and inflation, it is important to note that OPI accounts for the largest amount of general fund expenditures (approximately $797.7 million in FY 2019) when compared to any other state agency. A major source of growth for the Office of Public Instruction (OPI) is due to K-12 BASE Aid, which has increased nearly every legislative session. The legislature sets in statute the formula for the BASE Budget for all school districts and the amount of BASE Aid provided to school districts from state sources.

- The relatively large expenditures in FY 2010 were due to a one-time coal bonus payment to the guarantee account from Arch Coal.

- In FY 2012, a larger portion of K-12 BASE Aid was paid from the guarantee state special revenue account instead of the general fund.

General Fund

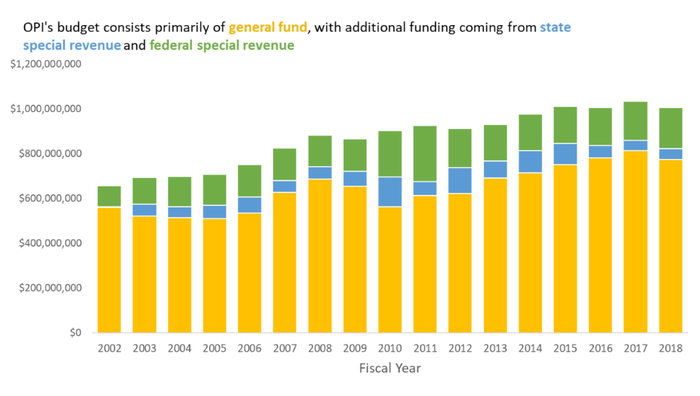

General fund accounts for a majority of spending for OPI, and nearly all general fund dollars are passed through to local school districts, primarily as K-12 BASE Aid.

State Special Revenue

Due to the small amount of state special revenue funding for OPI in comparison to general fund, the large percentages of change reflected in the chart above are actually the result of relatively smaller changes in dollar amounts.

The guarantee account is a state special revenue fund dedicated to school funding, and its funds are usually statutorily appropriated. The guarantee account receives revenue generated from common school state land as well as interest from the common school trust. Revenues are primarily generated from interest off the trust, as well as agriculture and extraction industry leases.

Click the double-sided arrow in the lower right corner of the image below to enlarge the graphic. Then, click the box next to the agency you want to see. To minimize, click Esc.

Legislative Studies

Education Interim Committee work

Audit Reports

Financial Compliance Audit - Office of Public Instruction - March 2020

Legislation

HB 15 K-12 inflation

HB 16 and fiscal note, Allow 3 and 4 year olds with disabilities in ANB calculations

HB 25 Clarify funding for education of children in residential treatment

HB 26 Clarify definition of a pupil

HB 27 Authorize school districts to create handle with care programs

HB 32 Repeal ending fund balance limits for school district funds

HB 33 Clarify school funding related to anticipated enrollment increases

HB 34 Revise statutes to reflect federal recognition of Little Shell Tribe

HB 46 Revise special education funding

HB 68 Provide early school enrollment for children of relocated military families

HB 69 Eliminate reduced price co-pays for school meals

HB 88 Revise laws on administration of TRS

HB 89 Revise transformational learning program

HB 112 and amendments, Require interscholastic athletes to participate under sex assigned at birth

HB 129 Revise the Family Education Savings Act

HB 143 Provide incentives for increasing starting teachers pay

HB 166, Expand transformational learning program to include magnet schools

HB 179, Revise laws related to community colleges

HB 185, Revise laws related to basic instructional program in high schools

HB 186, Revise laws related to teacher certification

HB 192, Revise laws related to school major maintenance funding

HB 207, Revise school bus safety laws

HB 227, Establish student mental health screening pilot program

HB 233, Revise funding for students with disabilities

HB 246, Revise education laws to enhance local control and opportunities for pupils

HB 267, Improve school bus safety laws

HB 279, Revise laws related to tax credit scholarship and innovative education programs

HB 286, Revise laws related to the Montana digital academy

HB 300, Revise school transportation laws

HB 303, Revise business equipment tax laws: BIG Jobs Act

HB 329, Establish the students with special needs equal opportunity act

HB 332, Revise school laws related to vaccinations

SB 18 Establish graduation requirements for educationally disrupted youth

SB 22 Clarify amount of support for state-level strengthening CTSO program

SB 23 and fiscal note, Eliminate state school flexibility account

SB 24 Allow nonoperating school districts to retain oil and gas revenue

SB 42 Allow use of school major maintenance funds for lead remediation

SB 72, Revise school laws related to participation in extracurricular activities

SB 74, Revise county school transportation laws

SB 75, Revise school funding laws related to unforeseen emergencies

SB 95, Revise school funding inflationary adjustment

SB 99, Establish parameters for K-12 human sexuality education

SB 109, revise laws related to gifted and talented education

SB 157, Allow students to participate in public school extracurriculars

SB 188, Revise school teacher retirement with pension

HB 277, Provide for a state government performance and results act (impacts LFC)

Gov. Gianforte 2023 Biennium Budget - Office of Public Instruction

2023 Biennium Executive Summary - Office of Public Instruction

Jan. 7 Budget

Nov. 15 Budget

Agency profile information provided by the Legislative Fiscal Division.