Montana State Legislature

State Auditor's Office

The State Auditor’s Office works to assure compliance with the Montana insurance and securities laws, promote captive insurance formations, support capital formation in the state, and assist consumers with complaints involving the securities and insurance industries. The State Auditor is charged with licensing, registering, and regulating insurance companies and producers, securities issuers, salespeople, brokerdealers, investment advisors, and investment adviser representatives within the state. The State Auditor also serves as a member of the Board of Land Commissioners and the Crop Hail Insurance Board.

The Office of the State Auditor is authorized under Article VI of the Montana Constitution and is designated the Commissioner of Securities in 2-15-1901, MCA and the Commissioner of Insurance in 2-15-1903, MCA. In those capacities, the State Auditor’s duties are generally defined in Title 30, Part 10 and Title 33 of the Montana Code Annotated. Other statutes related to the State Auditor’s Office include:

- State special revenue generated by fees and taxes that support the office are identified and defined in 33-2-705 through 708, MCA

- Unspent collections from securities licenses and permits are deposited into the general fund in accordance with 30-10-115, MCA

- The office manages the Fire and Police Retirement Program through 33-2-705, MCA and 50-3-109, MCA

The State Auditor’s Office consists of three programs with the following functions:

Central Management Division

- Provides administrative, personnel, budgeting and accounting functions

- Provides support in fulfilling the duties as a member of the State Land Board and Hail Insurance Board

- Acts as conduit for the distribution of the state Fire and Police Retirement program

Insurance Division

- Responsible for resolving insurance consumer inquiries and complaints involving agents, coverage, and companies

- Investigates insurance code and rules violations, including possible criminal violations, and refers cases to the county attorneys for prosecution

- Monitors the financial solvency of insurance companies operating in Montana through financial analysis and financial examination

- Collects premium taxes and company fees paid by insurance companies operating in Montana

- Reviews rate and form filings to ensure compliance with applicable insurance code

- Licenses and provides continuing education to insurance agents, agencies, and adjustors

Securities Division

- Responsible for registering security issuers, sales people, broker-dealers, investment advisers, and investment adviser representatives

- Investigates unregistered or fraudulent securities transactions

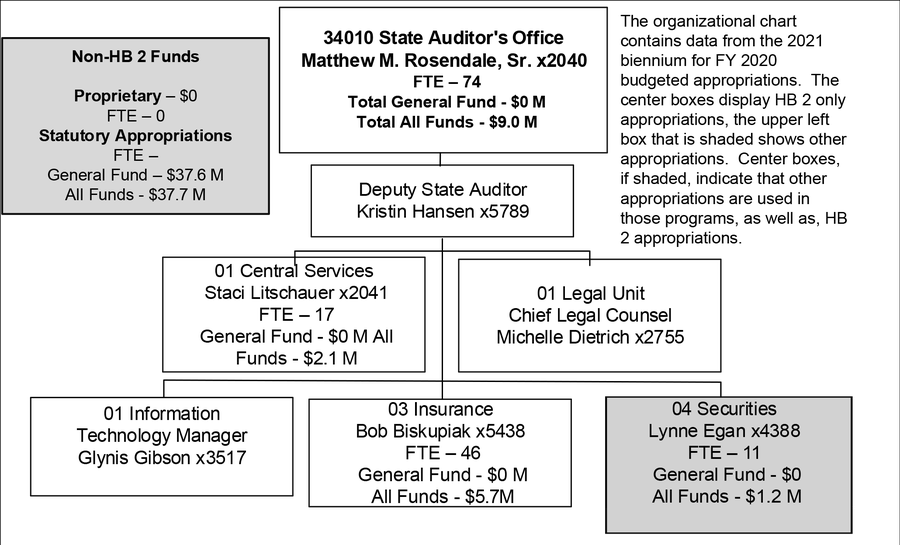

Below is an organizational chart of the office, including full-time employee (FTE) numbers and HB 2 general fund expenditures and total expenditures from all funds. Unless otherwise noted, all phone extensions are preceded by (406) 444.

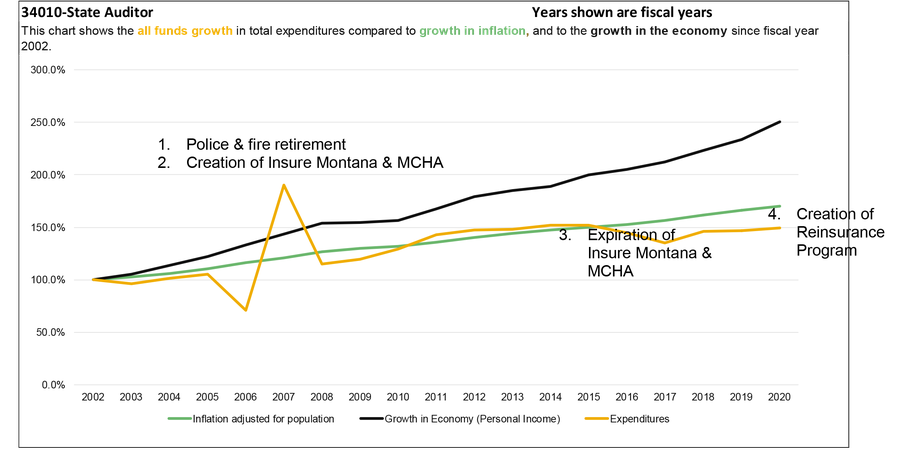

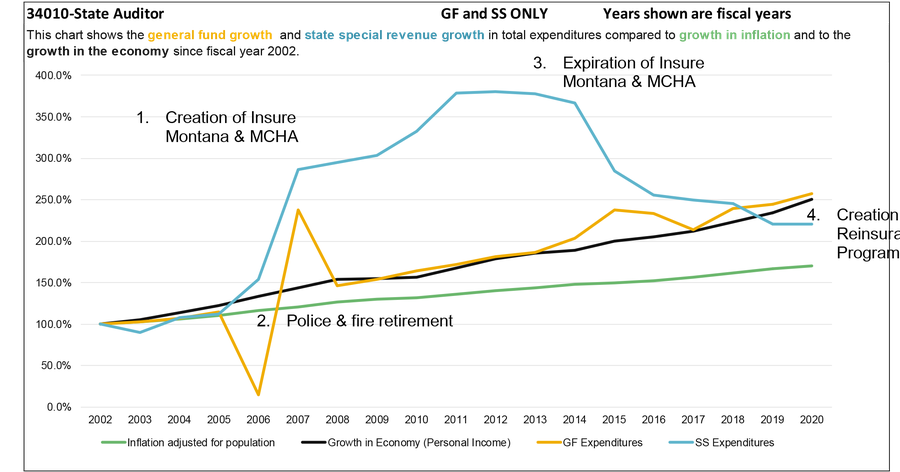

This report includes a series of charts that compare expenditure growth to the growth in the economy and growth in inflation adjusted for population. Montana statute, 17-8-106, MCA, recommends using growth in personal income for comparison purposes. Personal income is a measure for growth in the economy. Comparing growth allows financial planners to consider past and future demands in services or changes in revenues.

The following list discusses in more detail the inflection points on the charts:

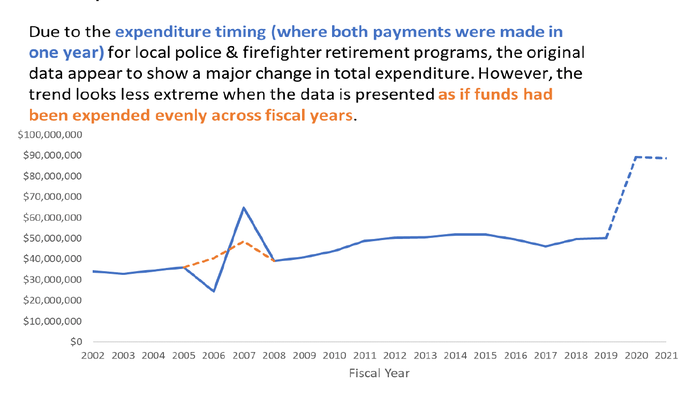

- In FY 2006 and FY 2007, the expenditure timing of pass-through payments to local police and firefighter retirement programs caused a drop and spike in the expenditures. Both payments were made in FY 2007, rather than half the amount being paid in FY 2006 and half in FY 2007. However, if the expenditures had been split evenly between FY 2006 and FY 2007, the trend in expenditures would have increased at a relatively consistent rate.

- Passed in November 2002, I-146 dedicated a portion of Montana’s tobacco settlement funds to the Montana Comprehensive Health Association (MCHA), which provided health insurance benefits to Montanans who could not otherwise afford or acquire health insurance. Additionally, the passage of Initiative 149 in 2004 increased tobacco taxes substantially, and a portion of this new revenue was allocated to the Insure Montana Program to help small businesses provide employee health insurance.

- In FY 2015, funding for both the Insure Montana Program and the Montana Comprehensive Health Association (MCHA) expired as the Affordable Care and Patient Protection Act provided health insurance for individuals previously covered in the other insurance programs.

- In FY 2020 and FY 2021, SB 125, enacted by the 2019 Legislature, established the Montana Reinsurance Association and created a new program within the State Auditor’s Office. The office was appropriated a total of approximately $9.9 million in state special revenue and $34.1 million in federal special revenues in each fiscal year for the program. The bill also implemented a 1.0% assessment on premium volume annually for major medical health insurers on the individual and employer group health insurance market and a 1.2% assessment on premium volume annually for other health, disability, and stop-loss insurers.

General Fund

General fund appears to account for most of spending for the State Auditor’s Office, but general fund dollars are almost all passed through to state and local governments through the Fire and Police Retirement Program and are not directly expended by the State Auditor’s Office.

State Special Revenue

Nearly all the primary functions for the State Auditor’s Office are funded with state special revenue. There are three major state special revenue accounts used by the agency: the insurance fee account, the captive account, and the securities fee account. Over the last 20 years, state special revenue expenditures increased until FY 2014 when they began to decline. This decrease is due to the expiration of the Insure Montana Program and the Montana Comprehensive Health Association (MCHA). The spike in state special revenue appropriations for FY 2020 and FY 2021 is due to the creation of the Montana Reinsurance Association.

Click the double-sided arrow in the lower right corner of the image below to enlarge the graphic. Then, click the box next to the agency you want to see. To minimize, click Esc.

Audit Reports

Financial Compliance Audit - For the two fiscal years ended June 30, 2018

Legislation

SB 236, Provide transparency in health care pricing

HB 551, Revise claimants’ ability to receive insurance information before litigation

SB 321, Establish an insulin price cap

Agency profile information provided by the Legislative Fiscal Division.